Comprehensive ESG and Credit Assessment

We provide a holistic and practical assessment of an issuer’s credit and sustainability profile that has distinct advantages over methodologies that focus purely on stand-alone ESG ratings. Guided by internationally-recognized frameworks such as the IFRS Sustainability Disclosure Standards, SASB, GRI, ESRS, and SFDR, we present ESG data and assessments in an intuitive, standardized form.

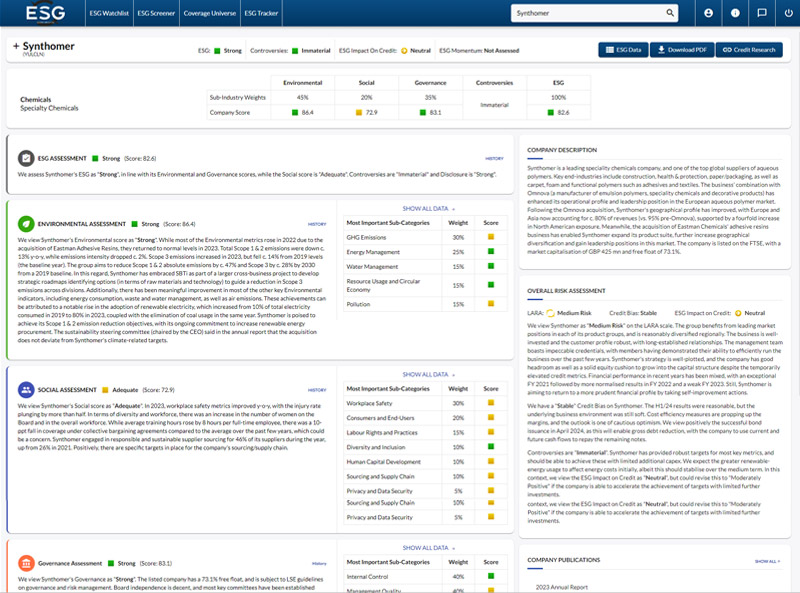

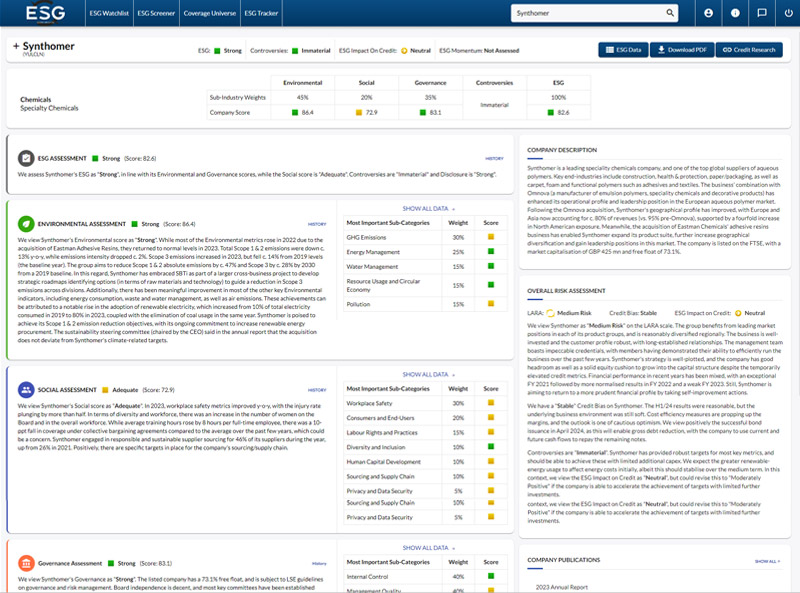

Integrated Proprietary ESG-Credit Analysis

Leveraging Lucror’s extensive fixed income expertise and advanced natural language processing technology, we sift through vast amounts of ESG data and distil each issuer’s ESG information into four pillar scores for Environmental, Social, Governance, and Disclosure. Their collective, industry-weighted impact on the credit is expressed through a five-tiered scale ranging from Highly Positive to Highly Negative. Lastly, we consider controversies to derive an overall ESG score and assessment.

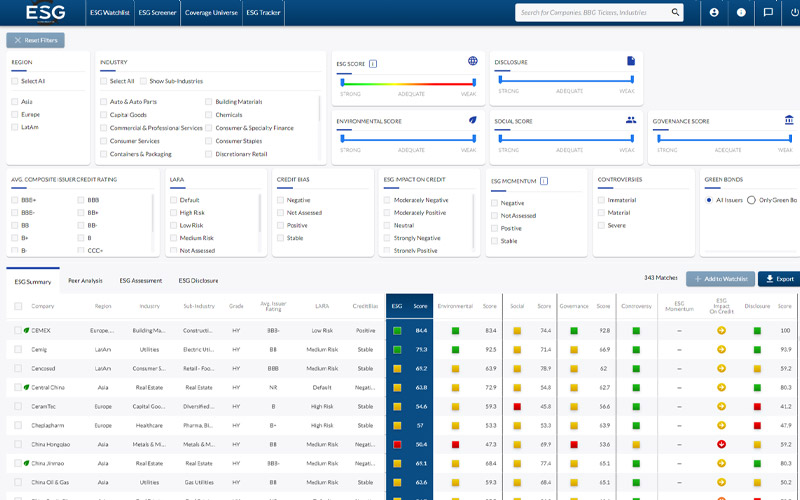

ESG Analytics

Lucror’s dynamic suite of ESG analytics enables clients to compare key qualitative and quantitative ESG metrics across companies, industries, and regions, driving a more effective sustainable investing process.

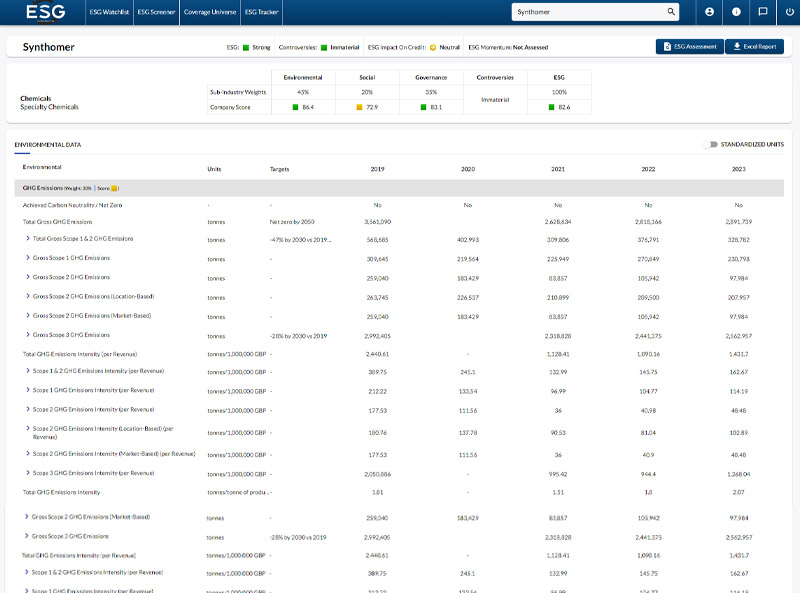

ESG Data

For each issuer, we analyse over 300 unique metrics across the Environmental, Social, Governance, and Disclosure pillars and distill these into 25 key factors. Lucror’s methodology is based on international ESG frameworks, including the IFRS Sustainability Disclosure Standards, SASB, GRI, ESRS, and SFDR, ensuring that the most important and relevant ESG data points are captured.