{{item.company?.length > 0 ? (item.company + ' - ' + item.name) : item.name}}

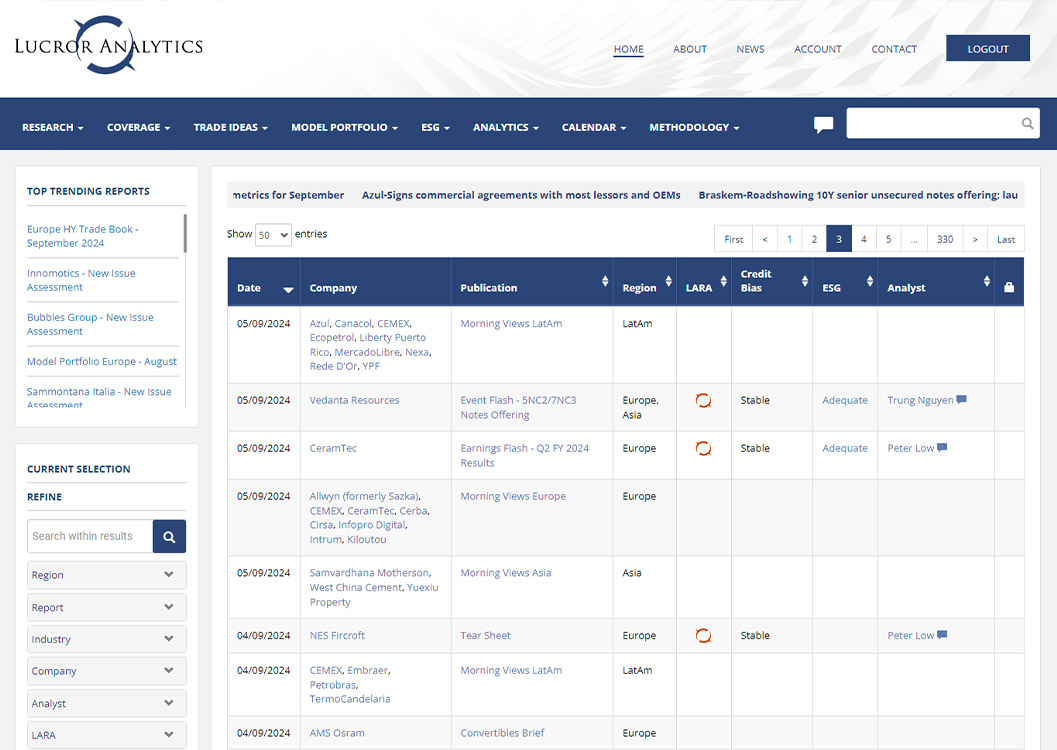

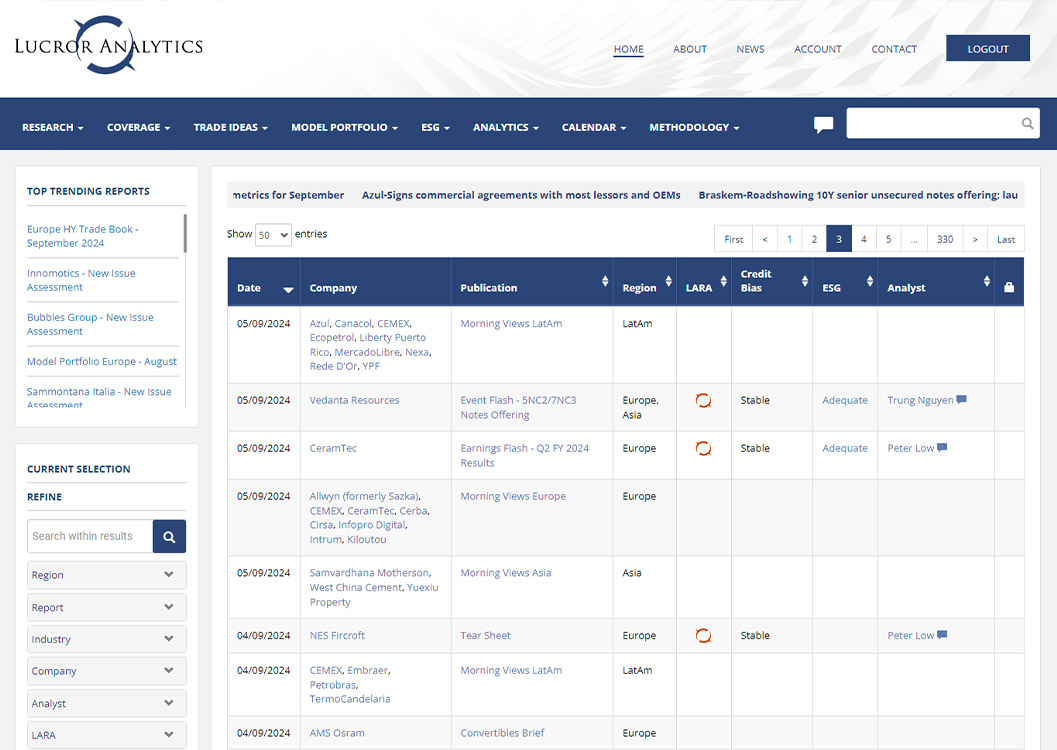

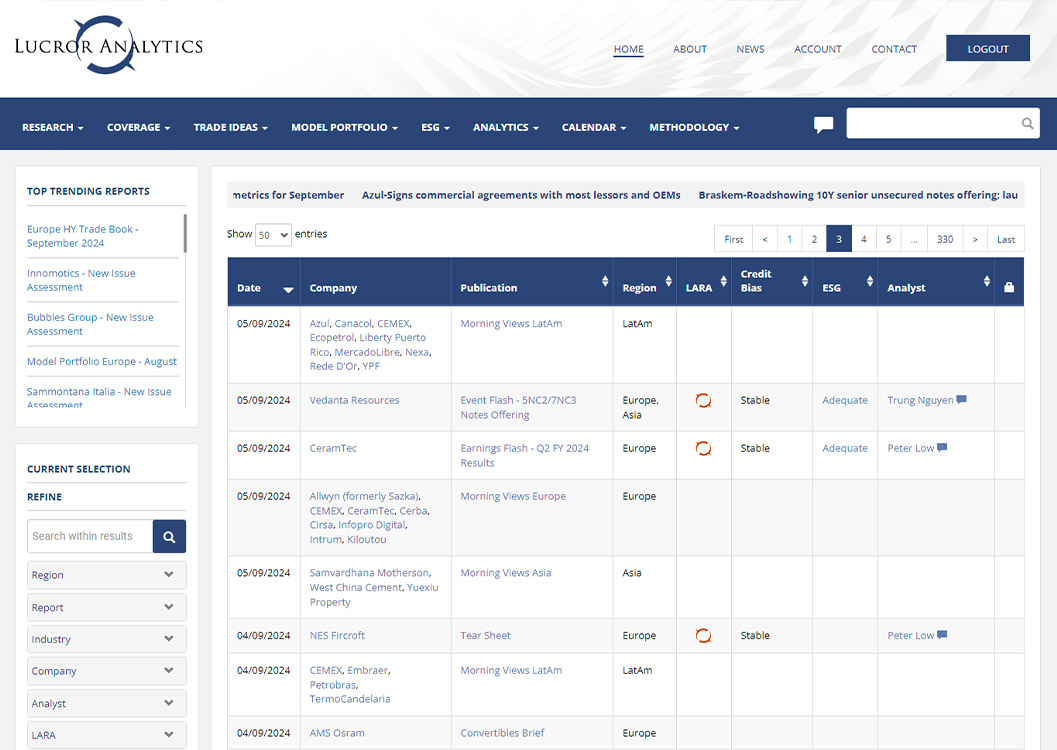

Lucror Analytics is a leading fixed income specialist in the complex high yield and crossover bond markets. Our integrated platform combines deep fundamental credit, ESG, and legal analysis with cutting-edge AI-driven data and analytics. We enable professional investors to generate alpha, efficiently build and manage portfolios, minimize default risks and substantially reduce costs.

Our credit research team is led by industry veterans with decades of experience in buy-side, sell-side and credit rating institutions. We have local analysts on the ground in each region that we cover.

Unrestricted access to our analysts and interactions with clients are integral parts of our service. During 1:1 discussions and team calls, our experienced team provides unique insights that go beyond written reports.

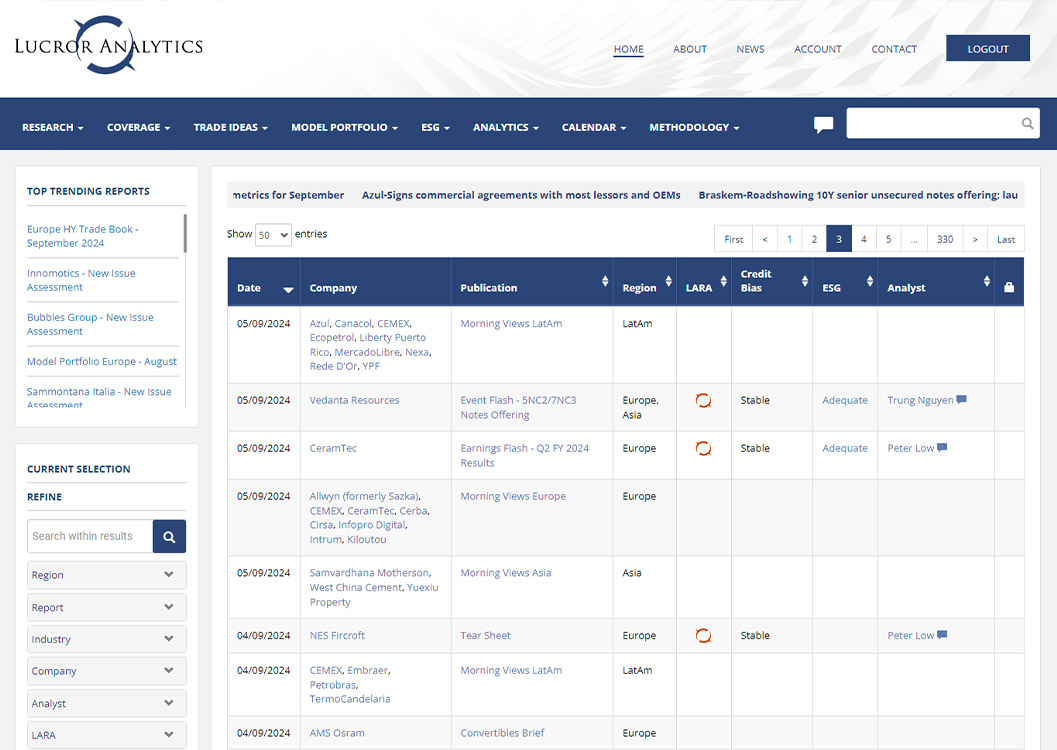

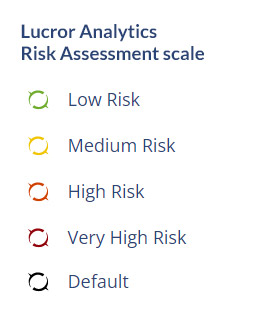

Our analysts distill their fundamental analysis and data inputs into actionable trade recommendations, expressed clearly and transparently. We have a strong focus on trade ideation and relative value, with a proven track record. Our regional Model Portfolios and Trade Book publications showcase core strategies and high-conviction ideas.

Drill down, visualize, and evaluate key qualitative and quantitative metrics across issuers and time for intuitive peer comparisons. Benchmark and compare companies across various financial metrics and ratios to identify relative value trade opportunities. Build and download summaries of historical and projected financials and key credit ratios.

We publish more than 1,200 reports every year and offer access to a database of thousands more reports and tens of thousands of data points, along with the analytical tools to visually display and compare data across time and between issuers.